Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Apple (AAPL), the world's most valued technology company, has seen its stock price almost halve from the peak value reached last year. The growing competition in the smartphone market and Apple's falling profits are the principal reasons for the stock decline. Its major component supplier Samsung (SSNLF.PK) has become Apple's biggest threat in the smartphone segment. Apple gets almost 50% of its revenues from iPhones, and its iPhone margins are much higher than its overall corporate margins. But Samsung has overtaken Apple in terms of growth and is now the world's leading smartphone seller. Though Samsung makes fewer profits than Apple in smartphones, the Cupertino company desperately wants to end its dependency on Samsung. Samsung is not only the world's biggest mobile device seller but also the world's biggest memory company and supplier of displays. Samsung generates an estimated $5 billion in revenues from the sale of logic processors for Apple's iPhones, iPads and iPods. Apple pays almost $10 billion each year to its principal competitor, if you also add other components such as memory and displays. There has never been such a strange relationship in the technology industry. Apple has been trying to reduce its dependency on Samsung for a long time and made a crucial decision to change its processor supplier to TSMC (TSM). However, there are some risks in making this change.

Why Apple is changing its processor supplier

Apple made a decision in 2008 to design its own logic processor after Intel (INTC) refused to play ball. The company designs its own "A" series of processors using ARM (ARMH) IP and gets those processors manufactured in Samsung's factories under a "foundry" relationship. Apple and Samsung have a long relationship going back to the early 2000, when Samsung became a supplier of memory and logic chips to Apple's iPods. The relationship grew stronger with time and Samsung also became a principal supplier of chips to Apple's iPhones and iPads. However, the relationship came under strain as Samsung started to compete with Apple by entering the tablet and smartphone markets. Apple's massive payments played a big part in helping Samsung become the world's biggest mobile devices company. I doubt whether Samsung could have become so successful without its in-house supply of cutting edge display and chip components. Apple pays Samsung a staggering $10 billion each year, which is a great source of strength for the Korean chaebol. Apple has been trying to wean itself from Samsung and has already diversified most of its display and memory sourcing to the Japanese companies such as Toshiba and Sharp. However, the company has not managed to find alternate suppliers of logic processors till date. The current move to source logic chips from TSMC in 2014 will mark the final big break with Samsung.

What is the "Foundry" Model

The big semiconductor companies such as Qualcomm (QCOM), Broadcom (BRCM), Nvidia (NVDA) and Advanced Micro Devices (AMD) do not produce chips on their own. In the "foundry" business model, these companies design the chips, while the actual manufacturing is done by foundries such as TSMC and Global Foundries. The reason behind foundry trend is the huge expense in building a new "fab" or semiconductor factory. It can cost ~$3-$5 billion to build a new fab which is beyond the financial capabilities of most companies. While the fabless model has the advantage of reducing capex, the disadvantage is that you cannot get sufficient capacity at the leading edge.

Why TSMC became Apple's choice

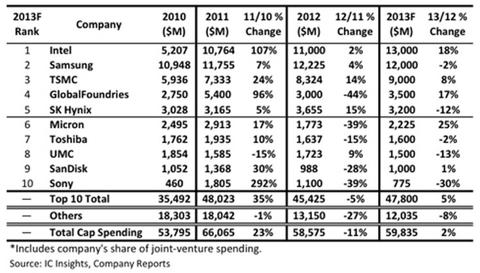

TSMC is the pioneer of the "fabless" model in the technology industry and the company has become one of the world's largest semiconductor companies. The company will be the 3rd largest spender on semiconductor equipment and will spend almost $8 billion in expansion and retooling its factories in 2013. It has left behind other foundries such as United Microelectronics (UMC) and Global Foundries both in size and technology. TSMC has managed to win a majority market share of the foundry business in recent times due to its large capacity at the 28 nm node. The other big foundry Samsung is struggling to get adequate yields at the 32 nm. TSMC has the capacity and scale to supply Apple's entire logic processor requirements.

However, TSMC might not be able to deliver because…

Though TSMC is a great company run by an excellent management, the company faces grave threat from Intel. The semiconductor giant has been aggressively shifting its priority from the declining PC market towards the mobile devices market. Intel has already introduced its own x86 based 32 nm chips for the tablet and smartphone market. The company plans to start making mobile chips on the world's leading 22 nm node by end 2013, using its proprietary 3D FinFET technology. The company will also start producing the first 14 nm chips by the end of the year with volume production expected by 2014. TSMC and other companies do not have the process and manufacturing expertise possessed by Intel. It is quite possible that Intel might be 2 Moore generations ahead of TSMC and other companies by 2014. This will give Intel an insurmountable lead in the semiconductor space as it will be able to manufacture highly sophisticated chips at much lower cost. The top companies such as Nvidia have expressed alarm about this and evenTSMC management has acknowledged this issue.

TSMC is also not giving in to Apple's capacity commitment

TSMC is a big player and has not been cowed by Apple's size and power. TSMC knows that Apple does not have a lot of choice, given that the other foundries do not have the capacity to meet Apple's huge chip requirements. The company reportedly did not agree to give Apple a dedicated capacity and also pushed back on other conditions.

Apple stock valuation and performance

Apple stock has become very reasonably valued and most of the risks have been discounted in the current stock price in my view. The stock is cheap on all common valuation measures such as P/S, forward P/E etc. The company is giving a healthy dividend of ~2.8% and is in the midst of the biggest buyback in history. Apple stock should also benefit from a new cycle of product launches in the upcoming year.

Summary

I think there are risks in Apple changing its supplier from Samsung to TSMC as Intel might leapfrog everyone else in chip technology over the next year. Samsung is already sampling Intel's current mobile chip for its new Galaxy Tab. Intel has a lot of unused leading edge factory capacity and it has hinted that it might even allow Apple to use its cutting edge manufacturing equipment to make ARM designed chips. I think that Apple may shift its foundry once again in 2014, if Intel executes as planned and that should help eliminate the TSMC risk. I remain positive on the Apple stock given its low valuation and upcoming product launches.